October 03, 2018Swati Khandelwal

The US-CERT has released a joint technical alert from the DHS, the FBI, and Treasury warning about a new ATM scheme being used by the prolific North Korean APT hacking group known as Hidden Cobra.

Hidden Cobra, also known as Lazarus Group and Guardians of Peace, is believed to be backed by the North Korean government and has previously launched attacks against a number of media organizations, aerospace, financial and critical infrastructure sectors across the world.

The group had also reportedly been associated with the WannaCry ransomware menace that last year shut down hospitals and big businesses worldwide, the SWIFT Banking attack in 2016, as well as the Sony Pictures hack in 2014.

ATTENTION: Click Here To Get Over $100,000 Money Transfer Through Bank Transfer Hackers!!!

ATTENTION: Get Your Hacked Western Union MTCN Transfer and Cash Out Over $2500 within minutes!!!

ATTENTION: Click Here For Your Blank/Cloned ATM Cards for ATM Cashout and Online Purchase!!!

Now, the FBI, the Department of Homeland Security (DHS), and the Department of the Treasury have released details about a new cyber attack, dubbed “FASTCash,” that Hidden Cobra has been using since at least 2016 to cash out ATMs by compromising the bank server.

FASTCash Hack Fools ATMs into Spitting Out Cash

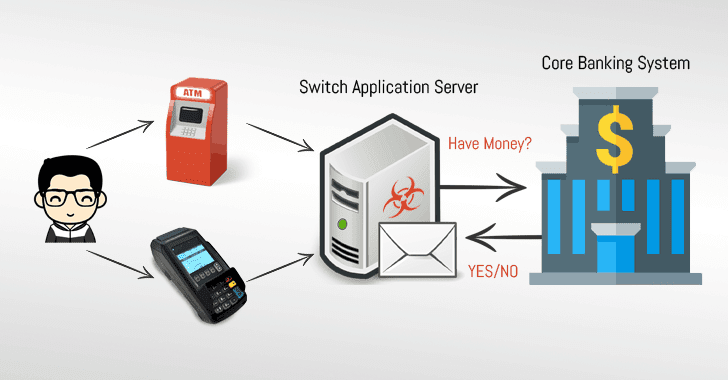

The investigators analyzed 10 malware samples associated with FASTCash

cyber attacks and found that attackers remotely compromise payment

“switch application servers” within the targeted banks to facilitate

fraudulent transactions.

Switch application server is an essential component of ATMs and

Point-of-Sale infrastructures that communicates with the core banking

system to validate user’s bank account details for a requested

transaction.

Whenever you use your payment card in an ATM or a PoS machine in a

retailer shop, the software asks (in ISO 8583 messages formats) the

bank’s switch application server to validate the transaction—accept or

decline, depending upon the available amount in your bank account.

However, Hidden Cobra attackers managed to compromise the switch

application servers at different banks, where they had accounts (and

their payment cards) with minimal activity or zero balances.

The malware installed on the compromised switch application servers then

intercepts transaction request associated with the attackers’ payment

cards and responds with fake but legitimate-looking affirmative response

without actually validating their available balance with the core

banking systems, eventually fooling ATMs to spit out a large number of

cash without even notifying the bank.

“According to a trusted partner’s estimation, HIDDEN COBRA actors have stolen tens of millions of dollars,” the reports says.

“In one incident in 2017, HIDDEN COBRA actors enabled cash to be simultaneously withdrawn from ATMs located in over 30 different countries. In another incident in 2018, HIDDEN COBRA actors enabled cash to be simultaneously withdrawn from ATMs in 23 different countries.”

Hidden Cobra threat actors are using the FASTCash scheme to target banks

in Africa and Asia, though the U.S. authorities are still investigating

the FASTCash incidents to confirm whether the attack targets banks in

the United States.

How Attackers Managed to Compromise Banks’ Switch Application Servers

Though the initial infection vector used to compromise Bank networks is

unknown, the U.S. authorities believe that the APT threat actors used

spear-phishing emails, containing malicious Windows executable, against

employees in different banks.

Once opened, the executable infected bank employees’ computers with

Windows-based malware, allowing hackers to move laterally through a

bank’s network using legitimate credentials and deploy malware onto the

payment switch application server.

Though most compromised switch application servers were found running

unsupported IBM Advanced Interactive eXecutive (AIX) operating system

versions, investigators found no evidence that attackers exploited any

vulnerability in AIX operating system.

US-CERT recommended banks to make two-factor authentication mandatory

before any user can access the switch application server, and use best

practices to protect their networks.

US-CERT has also provided a downloadable copy of IOCs (indicators of

compromise), to help you block them and enable network defenses to

reduce exposure to any malicious cyber activity by the Hidden Cobra

hacking group.

In May 2018, the US-CERT also published an advisory alerting users of two different malware—Remote Access Trojan (RAT) known as Joanap and Server Message Block (SMB) worm called Brambul—linked to Hidden Cobra.

Last year, the DHS and the FBI also issued an alert describing Hidden Cobra malware Delta Charlie—a DDoS tool that they believed North Korea uses to launch distributed denial-of-service attacks against its targets.

Other malware linked to Hidden Cobra in the past includes Destover, Wild

Positron or Duuzer, and Hangman with sophisticated capabilities, like DDoS botnets, keyloggers, remote access tools (RATs), and wiper malware.